They are influenced by elements like market demand, provide, volatility, and sentiment. It Is essential to watch these rates frequently and understand their developments somewhat than assuming they may stay constant. Throughout durations of excessive volatility, funding charges may expertise sharp spikes or dips, affecting the general cost of holding long or brief positions. The volatility of cryptocurrency costs is another main factor that impacts how funding mechanisms are adjusted. Excessive market volatility sometimes crypto funding rates explained results in increased danger for merchants, prompting frequent changes in these rates.

What's The Funding Rate?

Past performance of a BingX neighborhood member isn't a reliable indicator of his future performance. Content Material on BingX's buying and selling platform is generated by members of its community and does not contain recommendation or recommendations by or on behalf of BingX. In layman's phrases, a cryptocurrency trade is a spot where you meet and trade cryptocurrencies with one other person.

- This means tracking correlations between funding, volume, OI and technical indicators like transferring averages and RSI to get a whole view of market conditions.

- Fortunately, several instruments and platforms provide real-time updates across varied exchanges.

- Our information takes you thru the subtleties of funding price arbitrage with readability on its inner gears, tactical execution, and why robust knowledge is essential to mastering its advanced landscape.

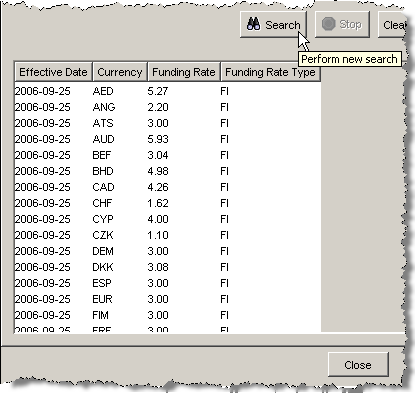

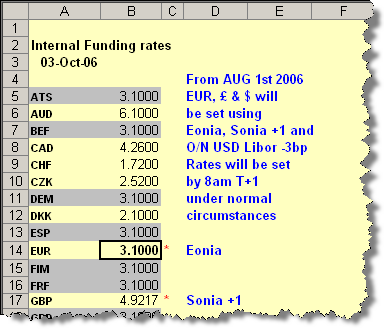

- These rates are periodic funds made based on the distinction between perpetual contract markets and spot prices.

- Understanding funding charges is crucial for crypto futures traders, as they immediately impression the worth of sustaining positions and might affect trading strategies.

Really Helpful Crypto Futures Exchanges

Well, when crypto futures funding charges diverge drastically from the spot costs https://www.xcritical.in/, there will be dangers and inefficiencies at scale. As talked about earlier, the funding price immediately impacts the trader’s holding prices and unrealized earnings and losses. A greater optimistic funding fee will increase the holding price for long positions. Conversely, a unfavorable funding price will increase the holding cost for brief positions. Regardless of whether the funding price is optimistic or unfavorable, a excessive funding rate can result in elevated market volatility. Even with low leverage, merchants should incur losses or face the danger of forced liquidation.

Uncover Coindive's advanced tools and group sources to strengthen your trading technique. Stop-loss orders play a vital position in limiting potential losses by automatically closing positions at preset worth ranges. Discovering the right balance is essential - setting stops too tight results in early exits from regular worth swings, while unfastened stops can outcome in extreme drawdowns. In 2023 and 2024, regulatory clarity in the united states Non-fungible token and EU allowed for extra clear derivatives buying and selling.

How Funding Rates Have An Result On Trading Strategies

This strategy is pulled off to return future contract prices to a reasonable vary. Beginning with the latter, it is a balancing mechanism, making certain that the prices of your perpetual swap contracts do not stay too removed from the underlying asset's spot prices, such as Bitcoin or Ethereum. Funding rate arbitrage plays on this course of by pinpointing and appearing upon any slip between funding rates and precise crypto spot costs. Historic data from sources like CoinGlass, TradingView, and exchange APIs can provide useful insights. For instance, analyzing historical funding rates may help establish patterns and predict future price adjustments, informing trading choices. Wave evaluation, particularly Elliott Wave theory, offers a structured method to understanding market cycles.

However like any tool, they work greatest when mixed with worth motion, liquidity, and broader market structure. When perpetual contracts first gained traction on platforms like BitMEX in 2018, funding rates have been a novel device. Initially risky and poorly understood, they have been vulnerable to manipulation and extreme swings. The bigger the gap between the contract and spot value, the higher the funding rate, which nudges traders to adjust their positions and bring costs closer. If you are a budget-conscious trader, as an example, buying and selling fees might matter a lot to you. Even should you've saved up on trading fees, you could miss out on substantial trading opportunities if you're not following the wave.

Regular portfolio monitoring and rebalancing helps maintain goal threat levels throughout totally different market circumstances. Spreading investments across different assets offers safety in opposition to poor efficiency in any single place. This approach balances potential features from funding rate alternatives with total portfolio stability. Rising OI alongside rising funding rates usually confirms the current trend's power.

How To Calculate Funding Rates Of Crypto Perpetual Futures

In traditional futures contracts, settlements happen on a monthly or quarterly basis, where contract costs converge with spot prices at the time of settlement. In distinction, perpetual contracts are a novel offering within the crypto-derivative house. They enable merchants to hold positions indefinitely with out expiration dates, functioning very like spot market trading. These methods focus on objectively capturing funding price differentials while managing directional exposure. These instruments mirror the spot market price closely, thanks to a unique mechanism often recognized as the funding rate. This price is pivotal in ensuring that the perpetual contract's price does not stray too far from the underlying asset's market price.